Is there always luck in investing?

Is that so?

This time, I would like to report the results of asset management for one year at WealthNavi!

We will approach the mystery of the results of fully automated investment services based on modern portfolio theory!

Introduction What is Wealth Navi?

WealthNavi is a service that automates all traditional asset management processes. Even those who are too busy to check social conditions and assets, or those who have no knowledge of investment and asset management, can easily invest and manage assets. Based on the “Modern Portfolio Theory” of Harry Markowitz, who won the Nobel Prize in 1990, world-class asset management has become a sales pitch. Each month, a specified amount is automatically diversified into stocks (US stocks, Japanese and European stocks, emerging market stocks), bonds, gold, and real estate. It has five levels of risk tolerance, and by investing in the world, it is said that in the medium to long term, returns exceeding the growth of the global economy have been realized. Conversely, if the global economy stagnates, it could lead to losses.

Source: WealthNavi Risk Simulation

Source: WealthNavi Risk Simulation

However, you can diversify your risk by accumulating the same amount every month like any other investment.

We invested 10,000 yen each month in WealthNavi for one year from February 2022. Separately, I deposited 30,000 yen in the bonus months (July and December), and 30,000 yen in August because the market price was down. This article is a good teaching material about savings and diversified investment, and parents and children will ♪ study it together.

But there can be no risk in investing! Did WealthNavi produce results?

What is Modern Portfolio Theory?

Simply put, it is a theory about the combination of assets. It is said to be a concept that leads to the optimal asset structure based on returns, risks, and expected values. In 1952, American economist Harry Markowitz published a paper on modern portfolio theory. According to modern portfolio theory, diversifying your assets into multiple assets can minimize risk while maintaining returns. Nowadays, this way of thinking has become the mainstream of investment. I feel that there are many people who do not know this theory, even if they invest in their own way and make similar investments (I also learned more about it this time).

What is your risk tolerance recommendation?

WealthNavi offers five levels of risk tolerance, and you must always choose one of them. Even if you are asked about your recommended risk tolerance, the amount of risk you take will vary depending on your age and annual income. Naturally, in order to get returns, you also have to take risks. Isn’t the theory that young people take risks and older people take stability?  Personally, while taking an aggressive stance … I also want protection… Risk tolerance is set to 4. I may be an evil demon who predicts that there will be a phase where all market prices will fall in the future due to stagnation of the world economy and infectious diseases.

Personally, while taking an aggressive stance … I also want protection… Risk tolerance is set to 4. I may be an evil demon who predicts that there will be a phase where all market prices will fall in the future due to stagnation of the world economy and infectious diseases.

What is risk tolerance?

Risk tolerance1

U.S. Stocks 11.4%, Japanese and European Stocks 5.0% Emerging Markets 5.0% U.S. Bonds 35.0% Inflation-Linked Bonds 33.6% Gold 5.0% Real Estate 5.0% It is a relatively stable portfolio with a focus on bonds that is low in risk. Naturally, returns are also suppressed.

Risk tolerance2

U.S. stocks 26.0%, Japanese and European stocks 12.5% Emerging market stocks 5.0% U.S. Treasuries 35.0% Inflation-linked bonds 11.5% Gold 5.0% Real estate 5.0% Slightly less risky. It is a relatively stable portfolio with a large number of bonds. The stock ratio has doubled from the tolerance of 1.

Risk tolerance3

U.S. Stocks 35.5%, Japanese and European Stocks 20.9% Emerging Markets 6.6% U.S. Treasuries 27.0% Gold 5.0% Real Estate 5.0% It is a portfolio managed with moderate risk and return. Tolerances after this point will eliminate inflation-linked bonds.

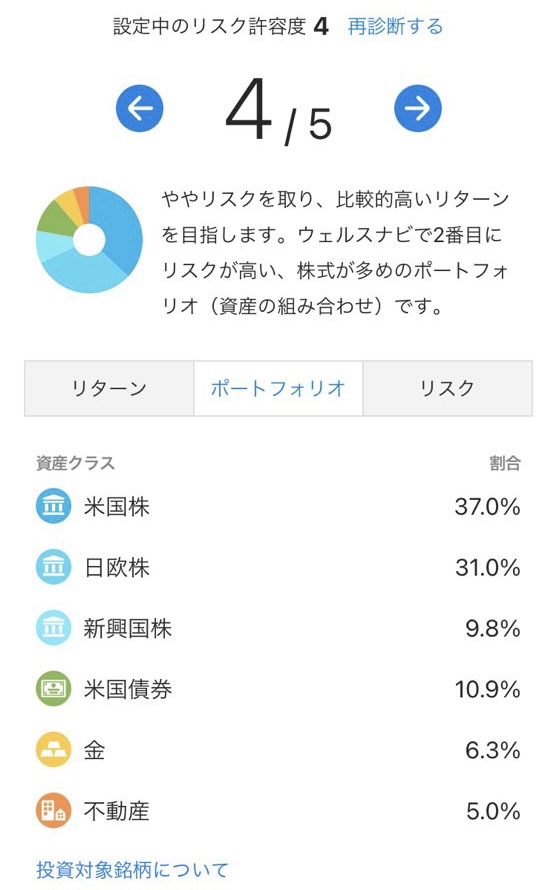

Risk tolerance4

US stocks 37.0%, Japanese and European stocks 31.0%, emerging market stocks 9.8% US Treasury bonds 10.9% Gold 6.3% Real estate 5.0% It is a portfolio that takes a little risk and is managed with the aim of relatively high returns. It consists of a large number of stocks. By the way, the percentage of gold is the highest in risk tolerance.

Risk tolerance5

U.S. stocks 37.0%, Japanese and European stocks 33.9% Emerging market stocks 14.1% U.S. Treasuries 5.0% Gold 5.0% Real estate 5.0% It takes risks and aims for high returns. It is composed mainly of stocks.

What is Asset Management?

Asset management is the distribution of your money to deposits, savings, and investments (stocks, bonds, real estate, FX, crypto assets, pure gold, trading cards, art works, etc.) It is an act that aims to prevent the value of assets from falling and increase assets. Investments, unlike bank deposits and savings, do not guarantee profits like interest, and the money invested is not guaranteed. When the asset value decreases from the principal (bid price), it is called “loss of principal“. It’s not just about putting money to sleep, it’s about letting money work for you. Money does not produce money even if you put it to bed. In addition, bank deposit rates are also sparrow’s tears. If the value of money falls, you will lose as much as it falls. Looking ahead to the Japan economy with a declining birthrate and aging population, we are worried about investment and savings that rely only on Japan domestic There is. Asset building classes have started in high school classes from 2022. The era is the smartphone era. We are now in an era where you can easily invest with your smartphone. Naturally, some people make big profits, while others go bankrupt. Investing can increase your money, but there is a risk of losing a lot of money if you do it wrong. It is necessary to learn about investment and economics and make efforts to reduce risks as much as possible.

Asset management is the distribution of your money to deposits, savings, and investments (stocks, bonds, real estate, FX, crypto assets, pure gold, trading cards, art works, etc.) It is an act that aims to prevent the value of assets from falling and increase assets. Investments, unlike bank deposits and savings, do not guarantee profits like interest, and the money invested is not guaranteed. When the asset value decreases from the principal (bid price), it is called “loss of principal“. It’s not just about putting money to sleep, it’s about letting money work for you. Money does not produce money even if you put it to bed. In addition, bank deposit rates are also sparrow’s tears. If the value of money falls, you will lose as much as it falls. Looking ahead to the Japan economy with a declining birthrate and aging population, we are worried about investment and savings that rely only on Japan domestic There is. Asset building classes have started in high school classes from 2022. The era is the smartphone era. We are now in an era where you can easily invest with your smartphone. Naturally, some people make big profits, while others go bankrupt. Investing can increase your money, but there is a risk of losing a lot of money if you do it wrong. It is necessary to learn about investment and economics and make efforts to reduce risks as much as possible.

What is the difference between investing and gambling?

Investment is the process of giving money to a target (companies, bonds, real estate, gold, crypto assets, trading cards, works of art, etc.) from various information and preferences. Therefore, if the object you invest in grows, you can earn a profit according to the growth. Speculation based on short-term transactions, such as margin trading for Forex and stock investment, is highly gambling, so you need to be careful. Gambling is something that is left to chance, such as “a half or a half” or “front or back”. When betting money with several participants, the total amount does not change in the system in which money is transferred from the loser to the winner. In that case, it becomes a zero-sum game, and the gambling structure is that participants compete for the money they bring in. Both investing and gambling are hard when you become addicted. Recently, it is said that the conversion rate of online casinos is high, but gambling is a mechanism where the body wins, so it is better to stop gambling for reasons that you want money. You can’t win just because the return rate is high! Be careful! Another feature is that if you lose a lot, you will try to recover your losses, and the stakes will increase without you knowing it, and there is a high possibility that you will go bankrupt. It is difficult to recoup gambling losses by gambling, partly due to mental problems. This is true not only for gambling, but also for investing. It means that everything is best in moderation.

What is chōka hanka?

Gambling using two dice. This chohan has been synonymous with gambling since the Edo period of Japan. The rule is to put two dice in a bowl-sized zaru and roll them, and guess whether the sum of the eyes that come out is a cho (even number) or a half (odd number). Many of you may have seen it in a period drama.

Report on the results of asset management for one year at WealthNavi [2022 edition]

This is the announcement of the results of investing 10,000 yen each month in WealthNavi for one year from February 2022! (Separately, 30,000 yen in the bonus month, and since the market price was down, I deposited 30,000 yen in August)

Save 2,482 yen in yen!

That… Very subtle … And I think you are there! No, it’s actually subtle, but 2022 is also a devil’s year that has killed so many investors. Starting with Russia’s invasion of Ukraine, the US interest rate hike, the angry yen depreciation rush … I remember having a very hard time. The chart trough speaks for itself. Under such circumstances, we are producing a positive risk tolerance of 4, so I think it is a good result. When it went down by 1st, it was minus nearly 10,000 yen … Investing is a win if you survive.

Chart when it was said that the dollar-yen exchange rate would exceed 150 yen

Chart when it was said that the dollar-yen exchange rate would exceed 150 yen

In conclusion

Personally, I feel that investing is mental. Experienced people may have had more bitter experiences. This time, I tried to verify whether I can make a profit with the fully automatic investment service. In recent years, I feel that the number of large individual investors and institutional investors who have introduced AI investment worldwide is increasing. The world of investment is a terrible world where people who can think about things that people don’t like and who can predict are profitable, so it may be possible to accumulate investments with Wealth Navi, where people’s thoughts do not interfere. Of course, even if you want to introduce Wealth Navi, we do not recommend you to invest in Wealth Navi. Think of it as a portfolio.

Don’t be impatient to invest?

Investing enriches the future, but don’t be impatient. Impatience not only clouds your thinking, but can also lead to sweet temptations such as poor money management and fraud. To some extent, I feel that it is important to forget that you are investing and make investments. If you are worried about the rise and fall of the market, you will get tired. In the future, we will continue to make regular investments in WealthNavi and verify the results! Thank you for reading to the end.

Playbox ♡ recommends long-term savings investments

◆Precautions for Investment◆

*Investing is risky and is at your own risk. There is no right way to invest. I hope you can read it as one way of thinking. If you don’t like risk, saving money is the way to go.

Khrapatyi (ふらぱてぃ)

Don't forget to enjoy "children's hearts"!

Let's change "boring" to "fun"!

Fun will be the sustenance of life ♡

This is a blog that focuses on child-rearing articles, YouTube video introductions, and miscellaneous articles from a professional and father's perspective by a social worker.

♥ Furari-chan (6 years old) The most beautiful girl in Japan. Gluttonous but small meal. I love cute things.

♥ Funi-kun (8 years old) A timid but kind brother. I love Pokemon.

■ Blog "Playbox ♡" (2021 / 10 ~)

Passed Google Ads examination (2022/1 ~)

■ Daughter Furari-chan and YouTube

"Play box ♡ Play box" (2021/9 ~)

Joining UUUM network (2021 / 10 ~)

Achieved 1000 registrants (2022/2)

I hope that playing with my father will lead to discoveries and learning.

Latest posts by Khrapatyi (ふらぱてぃ) (see all)

- [Why what?] Tokyo Disneyland Experience of the Corona Vortex [Closed in 2020 – Admission Restrictions] - 2023-02-11

- [Investing with parents and children! ] Results of asset management for one year with WealthNavi [2022 edition] - 2023-02-04

- [Why what?] "How much does the soul weigh?" from the theory of relativity [21 grams] - 2023-01-17

- 【Black Lotus Summary】Phantom card!? I’ll buy Black Lotus! - 2022-12-26

- [Why what?] "How to make a perpetual motion machine" that even children can understand - 2022-12-16

コメント